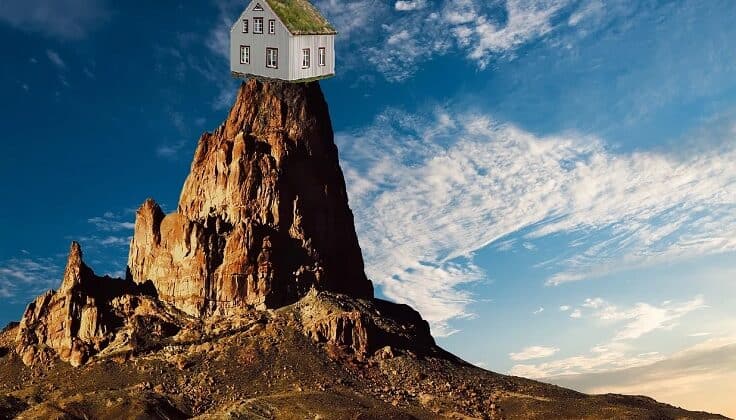

Is Home Ownership An Impossible Dream?

In previous posts, we’ve noted the immediate impact COVID has had on the Charlotte real estate market. Now the market is reeling again from the pandemic’s aftershocks. COVID has had a chaotic effect on the timber industry, and this in turn has translated into higher lumber costs, further hampering builders.

This is one nasty virus.

Of course, this is just the latest jolt to a housing market in turmoil. It’s been a lopsided seller’s market for longer than we can remember, and the continuing inventory problem has now reached a critical state. Analysts report an eye-popping 59.8% drop in homes for sale since January, 2020 – and keep in mind that this is after several record-breaking years of decreasing inventory.

The latest figures do not offer much comfort. As of January 31, 2021, the number of homes for sale in the greater Charlotte region plummeted by 5,013 units. This has spurred already skyrocketing prices. The median sales price grew by $32,500, an increase of 12.9% from last year. As to be expected, buyers are left with shrinking maneuvering room, and are finding themselves unable to negotiate. That trend has nudged up the percent of original price received by 2.9%, with homes closing at 98.9% of the sellers’ asking price. The homes that are moving do so at a red-hot pace, with the number of days on market until sale plunging from 46 days in 2020 to only 26 days, a drop of 43.5%.

One thing that home buyers and buyer’s agents are keeping their eyes on is the Mortgage Bankers Association’s estimate that 2.7 million homeowners are in payment reduction plans as a result of the sagging economy. It’s expected that many of these homes may go on the market, providing some relief to our nagging inventory problem. As always, we’re remaining on high alert in an unpredictable home market and a stressed economy.

These are the overall numbers for the greater Charlotte Metro area. For more detail, see the reports for Charlotte, Matthews, and Huntersville.